MTD IT

Making Tax Digital for Income Tax

Are you ready for the HUGE change coming to self assessment for Sole Traders & Landlords?

At Flexpert Accounting, we're dedicated to keeping you informed about important tax changes.

Let's take a look into the essentials of Making Tax Digital for Income Tax Self Assessment (MTD IT) and how it might affect you.

Are you ready for the HUGE change coming to self- assessment for Sole Traders & Landlords?

At Flexpert Accounting, we're dedicated to keeping you informed about important tax changes.

Let's take a look into the essentials of Making Tax Digital for Income Tax (MTD IT) and how it might affect you.

What is MTD IT?

MTD IT is an initiative by HM Revenue & Customs (HMRC) to modernise the UK's tax system.

The goal is to make tax administration more efficient and straightforward by requiring digital record-keeping and more frequent income reporting.

MTD IT is an initiative by HM Revenue & Customs (HMRC) to modernise the UK's tax system.

The goal is to make tax administration more efficient and straightforward by requiring digital record-keeping and more frequent income reporting.

Who Needs to Comply?

Starting from 6 April 2026, if you're a sole trader or landlord with an annual income over £50,000, you'll need to follow MTD IT rules.

This means keeping digital records and submitting updates to HMRC every quarter.

From 6 April 2027, this requirement will extend to those earning over £30,000 annually.

From 6 April 2028, the requirement will extend to those earning over £20,000 annually.

Who Needs to Comply?

Starting from 6 April 2026 , if you're a sole trader or landlord with an annual income over £50,000 , you'll need to follow MTD IT rules.

This means keeping digital records and submitting updates to HMRC every quarter.

From 6 April 2027 , this requirement will extend to those earning over £30,000 annually.

From 6 April 2028, the requirement will extend to those earning over £20,000 annually.

Are There Exemptions?

Yes, certain individuals may be exempt from MTD IT, including those:

With income below the £30,000 threshold.

Who cannot engage digitally due to age, disability, or location.

Whose religious beliefs are incompatible with digital record-keeping.

If you believe you qualify for an exemption, it's important to apply directly to HMRC.

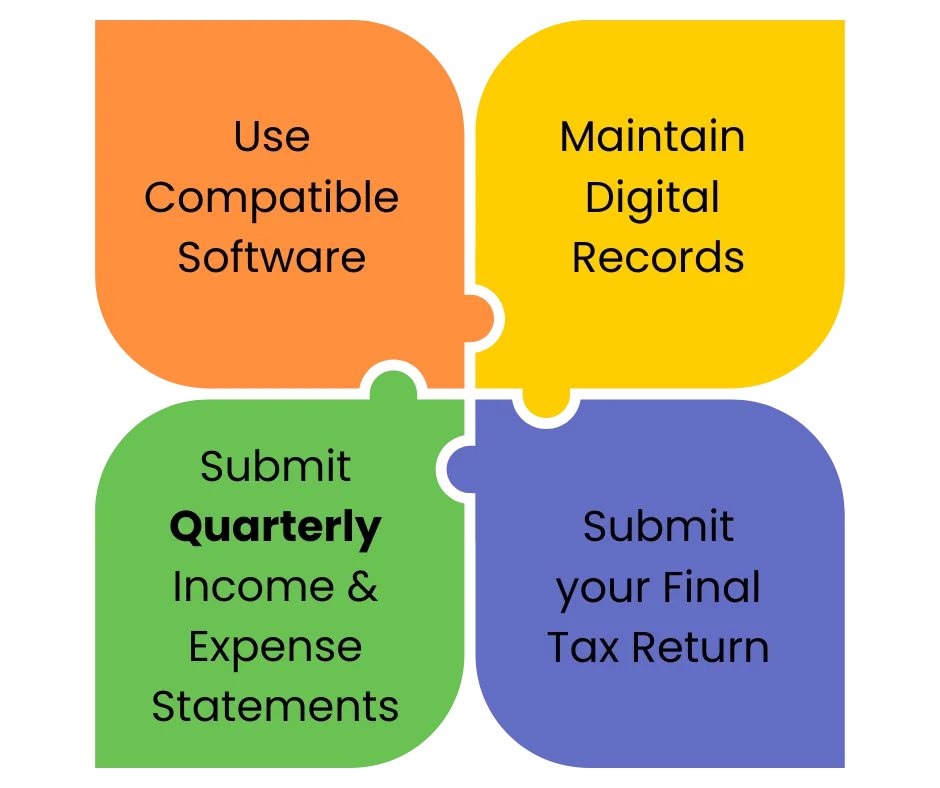

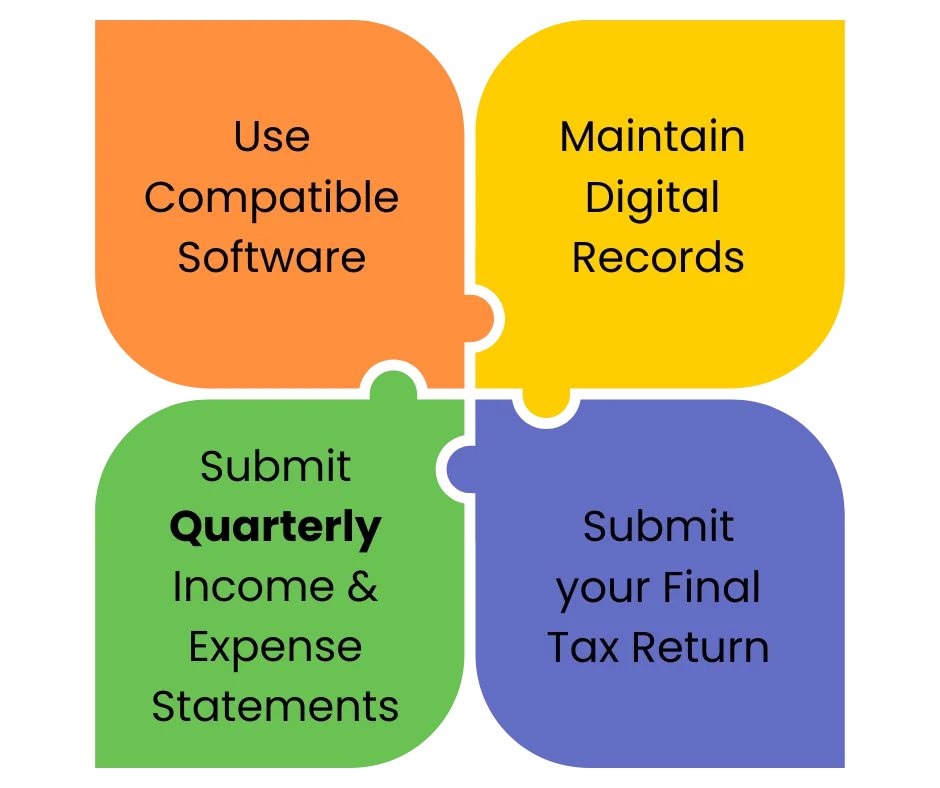

What Are the Key Requirements?

Under MTD IT, you'll be expected to:

Maintain Digital Records

Use compatible software to keep track of your income and expenses.

Submit Quarterly Updates

Provide HMRC with summaries of your earnings and expenditures every three months.

Make a Final Declaration

Declare that your submitted information is complete and correct, allowing HMRC to calculate your final tax liability.

What Are the Key Requirements?

Under MTD IT, you'll be expected to:

Maintain Digital Records

Use compatible software to keep track of your income and expenses.

Submit Quarterly Updates

Provide HMRC with summaries of your earnings and expenditures every three months.

Make a Final Declaration

Declare that your submitted information is complete and correct, allowing HMRC to calculate your final tax liability.

Are There Exemptions?

Yes, certain individuals may be exempt from MTD IT, including those:

With income below the £20,000 threshold.

Who cannot engage digitally due to age, disability, or location.

Whose religious beliefs are incompatible with digital record-keeping.

If you believe you qualify for an exemption, it's important to apply directly to HMRC.

How Can You Prepare?

To get ready for MTD IT:

Assess Your Income

Determine if your annual earnings from self-employment or property rentals exceed the relevant threshold.

Choose Compatible Software

Select a digital accounting solution that aligns with MTD requirements.

Stay Informed

Keep up with updates from HMRC and consider seeking advice from accounting professionals.

How can you prepare?

To get ready for MTD IT:

Assess Your Income

Determine if your annual earnings from self-employment or property rentals exceed the relevant threshold.

Choose Compatible Software

Select a digital accounting solution that aligns with MTD requirements.

Stay Informed

Keep up with updates from HMRC and consider seeking advice from accounting professionals.

Explore MTD Packages

We’ve worked hard to ensure our MTD IT package provides incredible value to all our clients.

The fee reflects the level of service and expertise we offer, as well as the costs we incur to provide a seamless experience for you. Here’s a breakdown of why the fee is structured this way:

Accounting Software Fees

The costs of the accounting software we use to ensure your records are MTD-compliant have increased, and we want to continue offering the best tools to keep your business in top shape.

Tax Submission Software Fees

As part of our commitment to staying fully compliant with HMRC’s new rules, we use premium tax submission software that ensures your submissions are done accurately and on time. These tools come with ongoing costs.

Time Spent on Bookkeeping and Review

To keep your records up-to-date, we dedicate time to reviewing your income and expenses, ensuring everything is properly categorised. This takes careful attention and is key to providing accurate quarterly reports.

Chasing Paperwork

We also spend time chasing paperwork and ensuring we have all the documents we need to prepare accurate filings. We understand this can be a hassle for you, which is why we handle it for you!

Ongoing Support

Throughout the year, we provide ongoing support, answering any queries you may have and helping you stay on top of deadlines, so you’re never caught off guard come tax season.

This price allows us to maintain the high level of support you’ve come to expect, while ensuring your business stays compliant and efficient with the latest tax requirements. We're here to help, every step of the way!

We’ve worked hard to ensure our MTD ITSA package provides incredible value to all our clients.

The fee reflects the level of service and expertise we offer, as well as the costs we incur to provide a seamless experience for you. Here’s a breakdown of why the fee is structured this way:

Accounting Software Fees

The costs of the accounting software we use to ensure your records are MTD-compliant have increased, and we want to continue offering the best tools to keep your business in top shape.

Tax Submission Software Fees

As part of our commitment to staying fully compliant with HMRC’s new rules, we use premium tax submission software that ensures your submissions are done accurately and on time. These tools come with ongoing costs.

Time Spent on Bookkeeping and Review

To keep your records up-to-date, we dedicate time to reviewing your income and expenses, ensuring everything is properly categorised. This takes careful attention and is key to providing accurate quarterly reports.

Chasing Paperwork

We also spend time chasing paperwork and ensuring we have all the documents we need to prepare accurate filings. We understand this can be a hassle for you, which is why we handle it for you!

Ongoing Support

Throughout the year, we provide ongoing support, answering any queries you may have and helping you stay on top of deadlines, so you’re never caught off guard come tax season.

This price allows us to maintain the high level of support you’ve come to expect, while ensuring your business stays compliant and efficient with the latest tax requirements. We're here to help, every step of the way!

Download our FREE Guide

Plus.... Bonus MTD IT Calendar!

Nuneaton | CV10 9JH

ICO: ZA741099

Copyright © 2024 FleXpert Accounting | All rights reserved

Download our FREE Guide

Plus.... Bonus MTD IT Calendar!

Nuneaton | CV10 9JH

ICO: ZA741099

Navigate

Quick Links

Get in touch

Copyright © 2024 FleXpert Accounting | All rights reserved