Be Prepared for

HMRC Audits!

Ever worry about what you’d do if HMRC asked to see your mileage log?

If you can't prove your mileage to HMRC, they may disallow your mileage expense claims, resulting in a higher tax bill as you won't be able to deduct those expenses.

You could face penalties and fines, as HMRC might view the lack of proper records as non-compliance.

They may also charge interest on any unpaid tax resulting from disallowed claims.

AND, your accounts could come under closer scrutiny, increasing the likelihood of a more comprehensive audit.

I’ve got something that will ensure you are fully compliant!

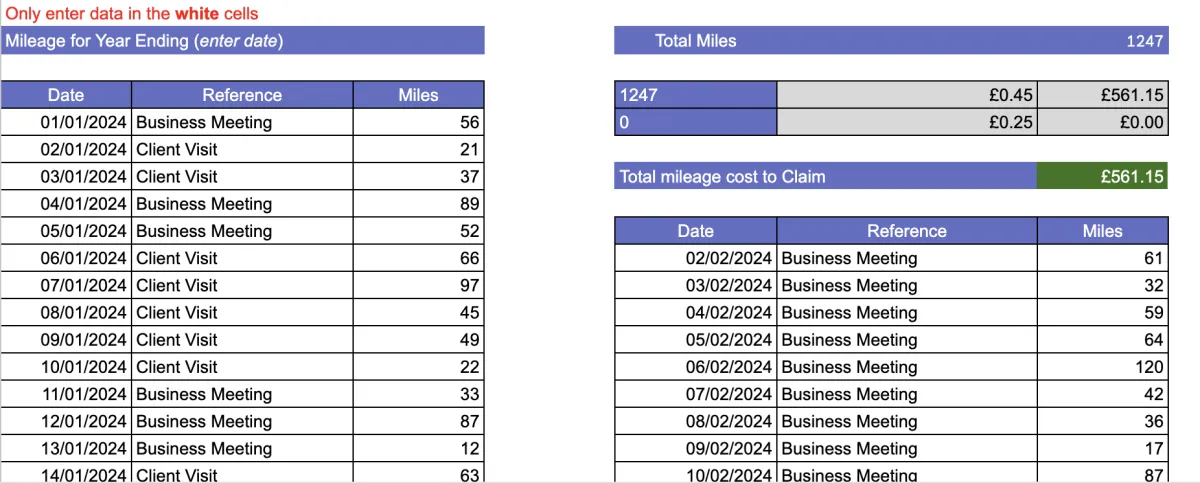

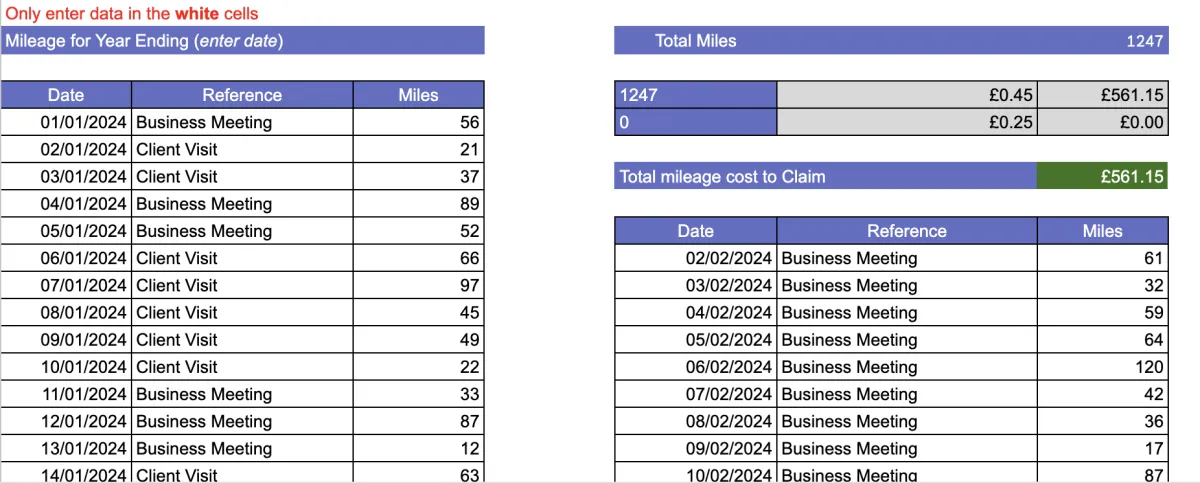

Your own Automated Mileage Tracker!!

Perfect for sole traders and small business owners who want to save time and stay compliant.

Super

Simple

Just pop in your mileage, and the tracker does the rest.

Always Accurate

It uses the latest HMRC rates, so you can relax knowing your claims are spot on.

Instant Results

Converts your miles to expenses instantly – no more boring calculations.

Time

Saver

Spend less time on paperwork and more time doing what you love.

Stress-

Free

No more worrying about missed claims or incorrect calculations.

Super

Simple

Just pop in your mileage, and the tracker does the rest.

Always Accurate

It uses the latest HMRC rates, so you can relax knowing your claims are spot on.

Instant Results

Converts your miles to expenses instantly – no more boring calculations.

Time

Saver

Spend less time on paperwork and more time doing what you love.

Stress-

Free

No more worrying about missed claims or incorrect calculations.

Ever worry about what you’d do if HMRC asked to see your mileage log?

If you can't prove your mileage to HMRC, they may disallow your mileage expense claims, resulting in a higher tax bill as you won't be able to deduct those expenses.

You could face penalties and fines, as HMRC might view the lack of proper records as non-compliance.

They may also charge interest on any unpaid tax resulting from disallowed claims.

AND, your accounts could come under closer scrutiny, increasing the likelihood of a more comprehensive audit.

I’ve got something that will ensure you are fully compliant!

Your own Automated Mileage Tracker!!

Perfect for sole traders and small business owners who want to save time and stay compliant.

Why You'll Love This Tracker

Super Simple

Just pop in your mileage, and the tracker does the rest.

Always Accurate

It uses the latest HMRC rates, so you can relax knowing your claims are spot on.

Instant Results

Converts your miles to expenses instantly – no more boring calculations.

Time Saver

Spend less time on paperwork and more time doing what you love.

Stress-Free

No more worrying about missed claims or incorrect calculations.

Super Simple

Just pop in your mileage, and the tracker does the rest.

Always Accurate

It uses the latest HMRC rates, so you can relax knowing your claims are spot on.

Instant Results

Converts your miles to expenses instantly – no more boring calculations.

Time Saver

Spend less time on paperwork and more time doing what you love.

Stress- Free

No more worrying about missed claims or incorrect calculations.

As an accountant with years of experience working with sole traders, I’ve seen how confusing and overwhelming the tax system can be.

Many clients struggle to understand what they can claim and how to maximise their savings.

That's why I'm dedicated to providing tools and resources, like our Automated Mileage Tracker, to make financial management simpler and more effective.

My goal is to help you avoid costly mistakes, reduce stress, and ensure you have peace of mind knowing your records are accurate and compliant.

Your success is my success, and I'm here to support you every step of the way.

As an accountant with years of experience working with sole traders, I’ve seen how confusing and overwhelming the tax system can be.

Many clients struggle to understand what they can claim and how to maximise their savings.

That's why I'm dedicated to providing tools and resources, like our Automated Mileage Tracker, to make financial management simpler and more effective.

My goal is to help you avoid costly mistakes, reduce stress, and ensure you have peace of mind knowing your records are accurate and compliant.

Your success is my success, and I'm here to support you every step of the way.

Nuneaton | CV10 9JH

ICO: ZA741099

Navigate

Quick Links

Get in touch

Copyright © 2024 FleXpert Accounting | All rights reserved