Small Business Packages

Affordable Accounting for Sole Traders

From Overwhelmed to in Control

Small Business Packages

Affordable Accounting for

Sole Traders

From Overwhelmed

to in Control

THE BEST INVESTMENT

For you and your business

You’ve built something incredible...your own business,

BUT......

Every month, you’re buried under a mountain of receipts, invoices, and half-filled spreadsheets.

You’ve tried doing it yourself...downloading generic software, watching endless YouTube tutorials, but it's fallen apart because you simply didn’t know what you were doing.

You catch yourself thinking, “I must be doing this wrong,” and worry HMRC might come knocking.

Here’s the truth...it’s not your fault. You’re a designer, a coach, a tradesperson, born to deliver value, not crunch numbers.

What you need is a system built for sole traders like you

That's exactly what we have created!

Simple, affordable, stress-free, and an incredibly easy way to record and manage your finances!

Who These Packages Are For

New sole traders

Just started your business and unsure where to begin with tax and bookkeeping? We’ll make sure you’re set up the right way from day one.

Busy business owners

You’d rather focus on your work than wrestle with spreadsheets and tax deadlines. We’ll keep things in order, so you don’t have to.

Self-employed workers who hate paperwork

If keeping track of receipts and numbers fills you with dread, don’t worry—we’ll handle it for you.

Sole traders who want to avoid HMRC stress

Late tax returns? Confusing letters? We make sure you stay compliant, so there are no nasty surprises.

Those who want personal support

No chatbots, no big call centres—just real, friendly accountants who actually know your business and care about helping you.

Anyone who wants peace of mind

Knowing your finances are in safe hands means you can focus on growing your business, stress-free.

It's as Simple as 123

Step 1

Choose your Package

Select which package you would like to proceed with

Step 2

Fill out our form

Fill out your details on our

simple form

Step 3

You're Done!

That's it!

We will handle the rest

About Us

Small Business Accountants

We’re FleXpert Accounting, a small family-run business that’s all about making life easier for sole traders like you. It’s just the two of us here...both AAT-qualified accountants, so you’ll always get a personal, down-to-earth service without being passed from person to person.

We know running a business comes with enough to-do lists, so we keep things simple.

Our secure portal and easy-to-use tools help you stay organised without the faff, leaving you more time to focus on what you love.

You do the business, we’ll handle the numbers—it’s as simple as that!

About Us

Small Business Accountants

We’re FleXpert Accounting, a small family-run business dedicated to helping small business owners

like you manage their finances with ease.

With just the two of us—both AAT-qualified accountants—you’ll always get a personal, friendly service that fits your needs.

We know how tricky running a business can be, so we’re here to make things as stress-free as possible for you.

Our secure portal and simple tools make it easy to stay organised, giving you more time to focus on what you love.

Let us handle the numbers while you grow your business!

Before Working With Us

It’s tax season, and the panic is real

There’s a pile of receipts shoved in a drawer, a spreadsheet that hasn’t been updated in months, and a growing sense of dread.

Hours spent trying to figure out expenses, and even then, there’s the worry of missing something important—or worse, overpaying.

The stress is constant, and business finances always feel like a guessing game.

After Working With Us

Tax deadline? Already sorted.

Receipts? Logged and organised.

Instead of stressing over spreadsheets, there’s peace of mind knowing everything is handled properly.

No last-minute panic, no missed deadlines—just clear, up-to-date finances and expert support whenever it’s needed.

More time, more confidence, and way less stress.

The Cost of Doing Nothing: Why You Can’t Afford to Wait

Ignoring your business finances might not seem like a big deal—until it is.

Putting off bookkeeping, tax returns, and financial planning can create bigger problems down the line, and by the time you realise it, the damage is done.

Missed tax deadlines = hefty HMRC fines

HMRC doesn’t do reminders—they do penalties. A late tax return could mean automatic fines, plus interest on any unpaid tax. The longer it’s left, the worse it gets

Disorganised bookkeeping = stress and wasted time

Scrambling to pull everything together at the last minute isn’t just frustrating—it eats up valuable hours you could be spending on your business (or, you know, enjoying your life).

No financial tracking = cash flow problems

Without proper records, it’s easy to lose track of what’s coming in and going out. Overspending, undercharging, or missing unpaid invoices can quickly put a strain on your business.

Missed expenses = paying more tax

Every lost receipt or forgotten expense claim means you’re handing over more money to HMRC than necessary. That’s money that should be staying in your pocket!

Waiting until ‘later’ = bigger problems to fix

Finances don’t sort themselves out, and the longer things are left, the harder they become to untangle. Sorting your accounts now means peace of mind, no nasty surprises, and a business that runs smoothly.

The good news... You don’t have to do it alone.

Our Sole Trader Packages are designed to keep you organised, compliant, and stress-free so you can avoid these common pitfalls and focus on what you do best.

The best time to get your finances in order was yesterday.

The second-best time? Right now!

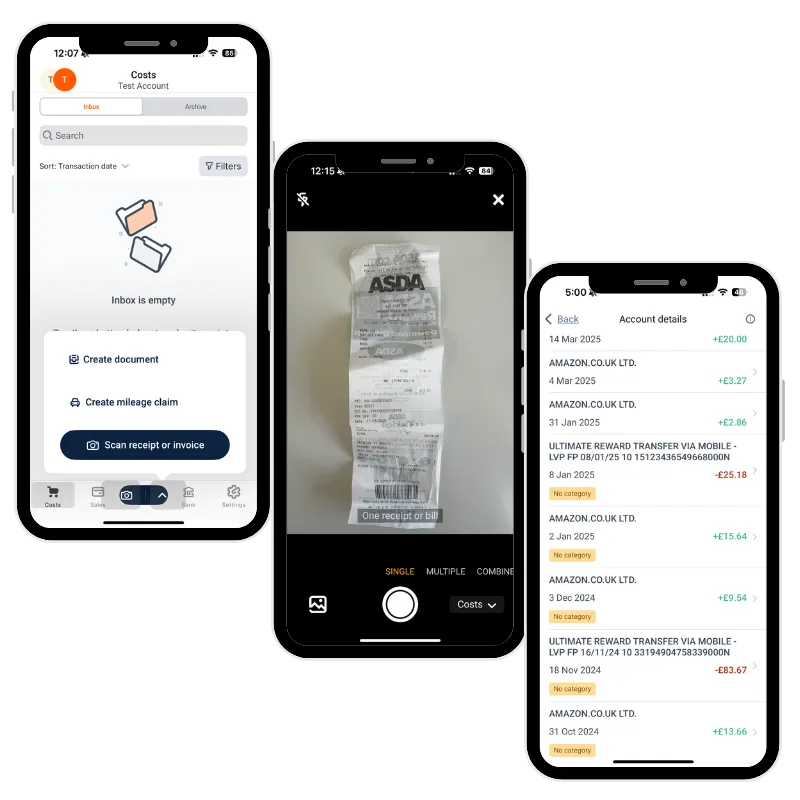

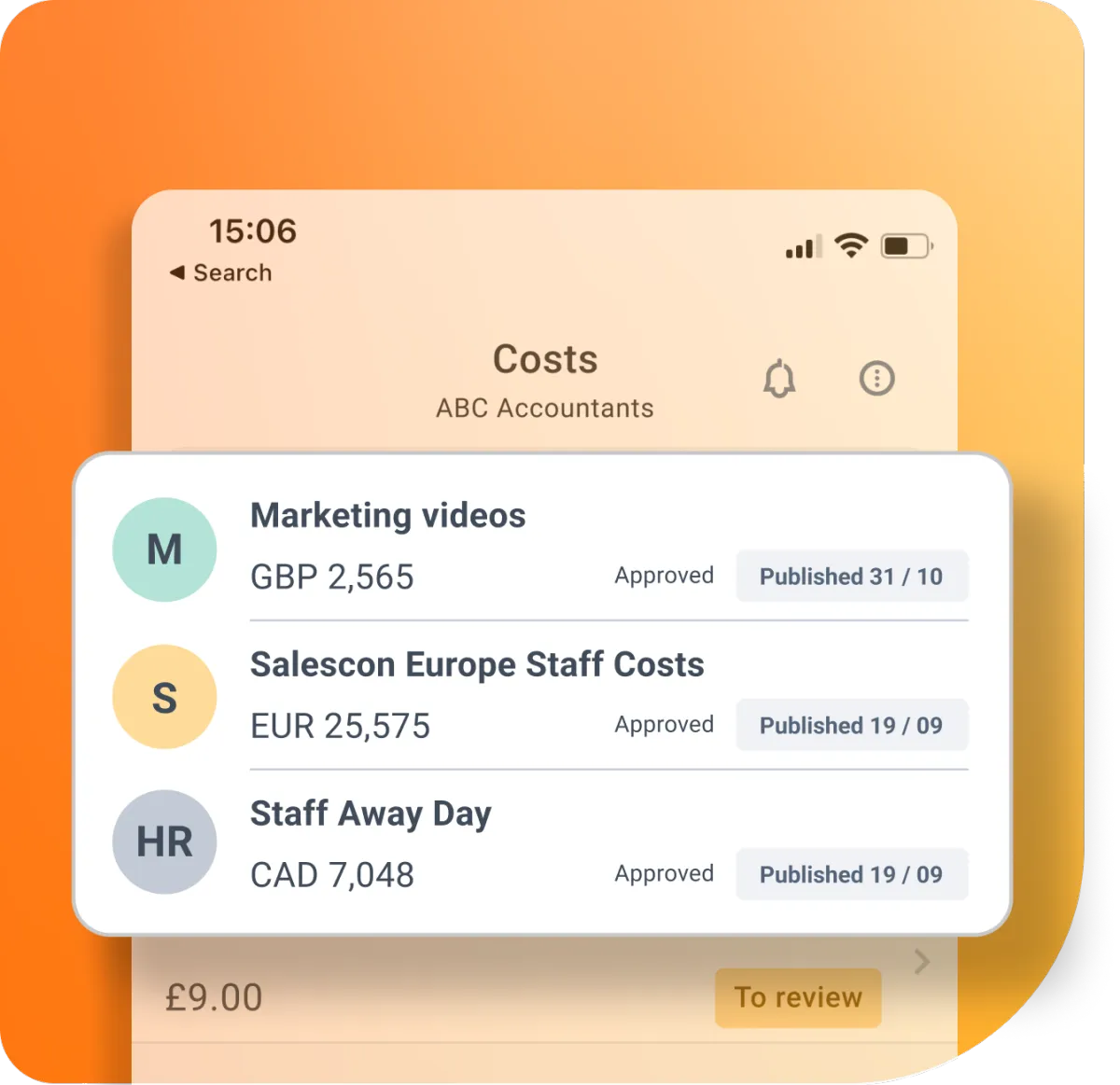

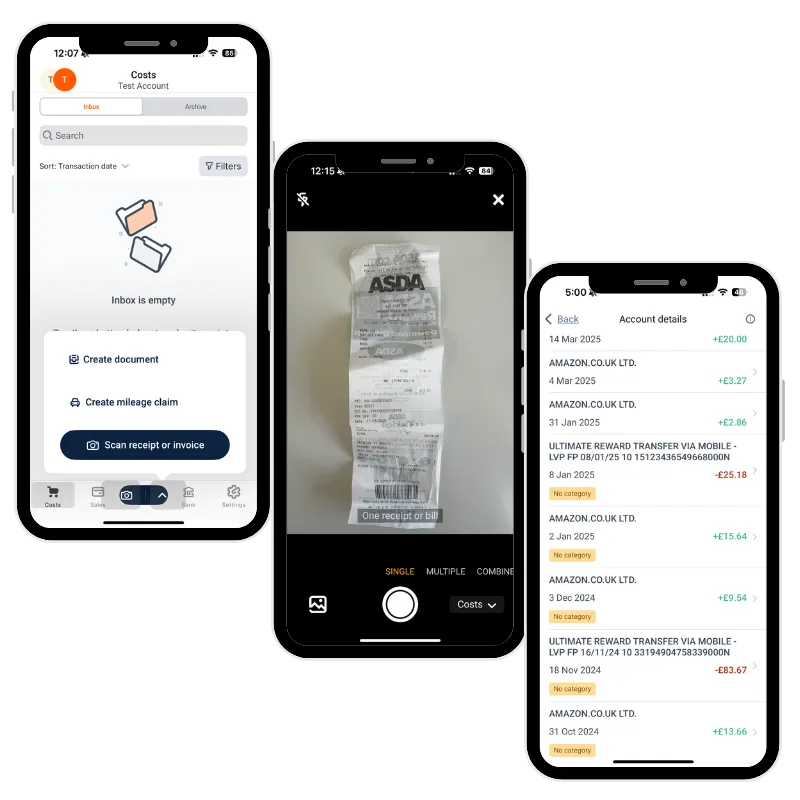

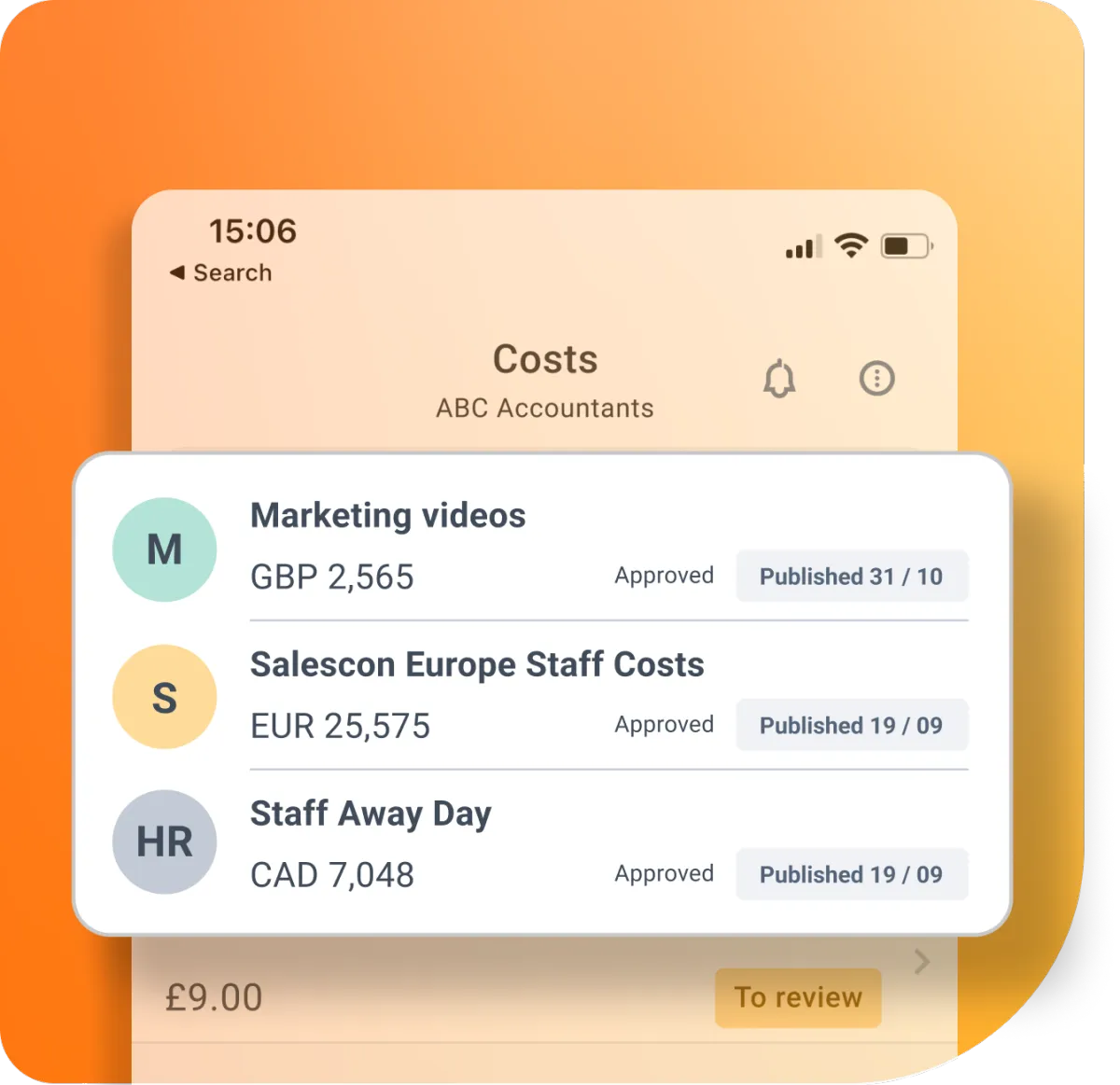

A Glance at the App

Snap receipts in seconds

Send Quotes

Categorise all of your transaction

Connect your business bank account

Track and record your mileage on the go

Connect to accounting software

Keep everything in one place

Save hours on bookkeeping

Stay HMRC-ready

MTD Compatible

OUR PACKAGES

THE BEST INVESTMENT

For you and your business

You’ve built something incredible...your own business, BUT......

Every month, you’re buried under a mountain of receipts, invoices, and half-filled spreadsheets.

You’ve tried doing it yourself...downloading generic software, watching endless YouTube tutorials, but it's fallen apart because you simply didn’t know what you were doing.

You catch yourself thinking, “I must be doing this wrong,” and worry HMRC might come knocking.

Here’s the truth...it’s not your fault. You’re a designer, a coach, a tradesperson, born to deliver value, not crunch numbers.

What you need is a system built for sole traders like you

That's exactly what we have created!

Simple, affordable, stress-free, and an incredibly easy way to record and manage your finances!

Who These Packages Are For

New sole traders

Just started your business and unsure where to begin with tax and bookkeeping? We’ll make sure you’re set up the right way from day one.

Busy business owners

You’d rather focus on your work than wrestle with spreadsheets and tax deadlines. We’ll keep things in order, so you don’t have to.

Self-employed workers who hate paperwork

If keeping track of receipts and numbers fills you with dread, don’t worry—we’ll handle it for you.

Sole traders who want to avoid HMRC stress

Late tax returns? Confusing letters? We make sure you stay compliant, so there are no nasty surprises.

Those who want personal support

No chatbots, no big call centres—just real, friendly accountants who actually know your business and care about helping you.

Anyone who wants peace of mind

Knowing your finances are in safe hands means you can focus on growing your business, stress-free.

It's as Simple as 123

Step 1

Choose your Package

Select which package you would like to proceed with

Step 2

Fill out our form

Fill out your details on our

simple form

Step 3

You're Done!

That's it!

We will handle the rest

About Us

Small Business Accountants

We’re FleXpert Accounting, a small family-run business that’s all about making life easier for sole traders like you. It’s just the two of us here...both AAT-qualified accountants, so you’ll always get a personal, down-to-earth service without being passed from person to person.

We know running a business comes with enough to-do lists, so we keep things simple.

Our secure portal and easy-to-use tools help you stay organised without the faff, leaving you more time to focus on what you love.

You do the business, we’ll handle the numbers—it’s as simple as that!

Before Working With Us

It’s tax season, and the panic is real

There’s a pile of receipts shoved in a drawer, a spreadsheet that hasn’t been updated in months, and a growing sense of dread.

Hours are spent trying to figure out expenses, and even then, there’s the worry of missing something important—or worse, overpaying.

The stress is constant, and business finances always feel like a guessing game.

After Working With Us

Tax deadline? Already sorted.

Receipts? Logged and organised.

Instead of stressing over spreadsheets, there’s peace of mind knowing everything is handled properly.

No last-minute panic, no missed deadlines—just clear, up-to-date finances and expert support whenever it’s needed.

More time, more confidence, and way less stress.

The Cost of Doing Nothing

Why You Can’t Afford to Wait

Ignoring your business finances might not seem like a big deal...

until it is.

Putting off bookkeeping, tax returns, and financial planning can create bigger problems down the line, and by the time you realise it, the damage is done.

Missed tax deadlines

= hefty HMRC fines

HMRC doesn’t do reminders—they do penalties. A late tax return could mean automatic fines, plus interest on any unpaid tax. The longer it’s left, the worse it gets.

Disorganised bookkeeping = stress and wasted time

Scrambling to pull everything together at the last minute isn’t just frustrating—it eats up valuable hours you could be spending on your business (or, you know, enjoying your life).

No financial tracking

= cash flow problems

Without proper records, it’s easy to lose track of what’s coming in and going out. Overspending, undercharging, or missing unpaid invoices can quickly put a strain on your business.

Missed expenses

= paying more tax

Every lost receipt or forgotten expense claim means you’re handing over more money to HMRC than necessary. That’s money that should be staying in your pocket!

Waiting until ‘later’

= bigger problems to fix

Finances don’t sort themselves out, and the longer things are left, the harder they become to untangle. Sorting your accounts now means peace of mind, no nasty surprises, and a business that runs smoothly.

The good news...

You don’t have to do it alone.

Our Sole Trader Packages are designed to keep you organised, compliant, and stress-free so you can avoid these common pitfalls and focus on what you do best.

The best time to get your finances in order was yesterday.

The second-best time?

Right now!

A Glance at the App

Snap receipts in seconds

Send Quotes

Categorise every transaction

Connect business bank account

Track & record mileage on the go

Connect to accounting software

Keep everything in one place

Save hours on bookkeeping

Stay HMRC-ready

MTD Compatible

OUR PACKAGES

Frequently Asked Questions...

What if I don’t know which package to choose?

No worries! If you’re unsure, just get in touch, and we’ll help you figure out which package best suits your business. We’ll chat about what you need, what you don’t, and make sure you’re getting the right level of support—without paying for extras you don’t need.

Can I upgrade or change my package later?

Absolutely! Your business isn’t set in stone, and neither are our packages. If you need more support down the line or want to switch things up, just let us know, and we’ll adjust your package to fit.

What happens if I get an HMRC letter I don’t understand?

Take a deep breath—then send it to us! We’ll explain what it means in plain English and let you know if there’s anything that needs to be done. No stress, no panic—just expert support when you need it.

Do I have to sign a long-term contract?

Our packages come with a 12-month minimum term because we believe in providing consistent, reliable support to help your business thrive. This means no sudden changes, no unexpected fees—just steady, expert guidance throughout the year. After the initial 12 months, you can continue with us or review your options, but we’re confident you’ll love having us in your corner!

What if I already have an accountant?

That’s fine! If you’re thinking of switching, we can make the process super smooth. We’ll handle everything with your current accountant and make sure all your financials are transferred over hassle-free.

How do I get started?

It’s easy! Just pick a package, sign up, and we’ll guide you through the next steps. We’ll make sure everything is set up properly so you can get back to running your business

Nuneaton | CV10 9JH

ICO: ZA741099

Navigate

Quick Links

Get in touch

Copyright © 2024 FleXpert Accounting | All rights reserved